Industry experts and guest contributors Aaron Vermut, Ron Suber and Patrick McCurdy – all from Merlin Securities – discuss the hedge fund business model and best practices for funds to get to the “green zone,” where fixed revenues exceed fixed expenses.

2010 was a transformative year for the hedge fund industry and served as a strong reminder that managing money is not the same as running a business. The significant number of small, mid-size and large fund closures already in 2011 provides continuing evidence of the material, multifaceted challenges facing operators of hedge fund businesses. Managers who understand the distinction between managing money and running a business and who execute both effectively are best positioned to maintain a sustainable and prosperous business – to achieve not only investment alpha, but also enterprise alpha.

Merlin’s latest white paper – The Business of Running a Hedge Fund – examines the hedge fund business model shares the best practices we have witnessed among “green zone” hedge funds that are well positioned for sustainability across a variety of economic and market conditions.

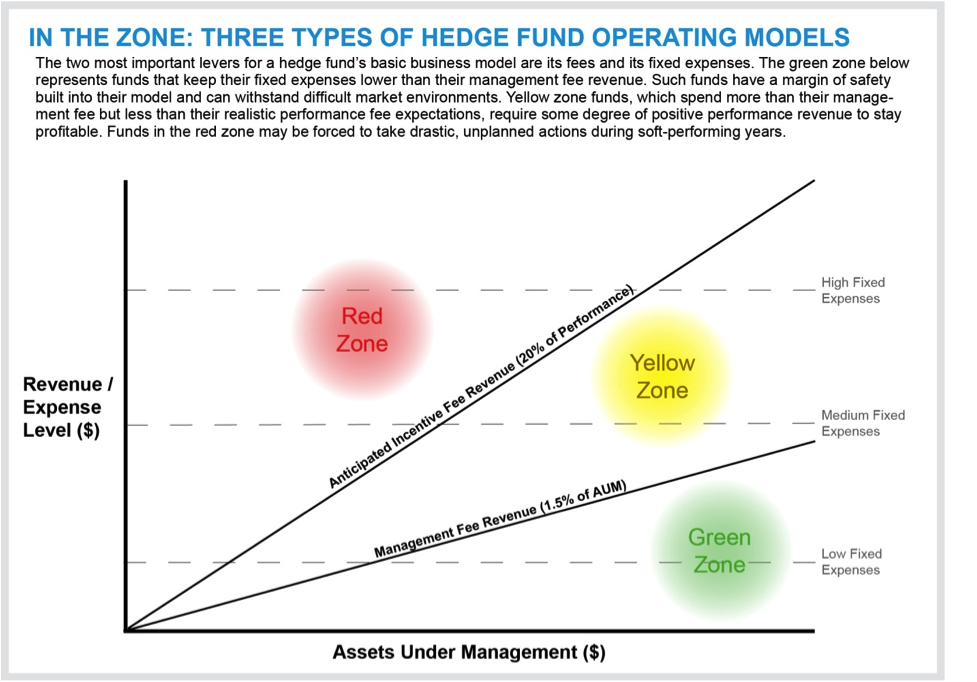

As a starting point, the diagram below highlights the basic revenue and expense scenarios that describe three types of hedge fund operating models: red zone, yellow zone and green zone. A fund operating in the red zone is dependent on outsized performance to cover its expenses; a fund in the yellow zone requires minimal performance; and a green zone fund can sustain itself when its performance is lower than expected, nonexistent or even negative. Funds that structure their business model to operate in the green zone are better positioned to navigate through downturns and therefore have higher survival rates over the long term.

The full paper, available here, examines hedge fund revenue inputs, expenses and business model considerations. We discuss the importance of identifying a fund’s breakeven point (i.e., the point at which revenues cover expenses) and seek to isolate several practices that have helped funds operate in, or closer to, the green zone.

Leave a Reply