Industry experts and guest contributors Ron Suber, John Quartararo and Patrick McCurdy – all from Merlin Securities – discuss the many types of hedge fund investors, from individuals to the largest institutions. Importantly, they also discuss which types of funds should target which investors, and when.

Running a hedge fund has never been harder. Established managers are struggling simply to keep moving forward against increasing redemptions and perilous markets. New managers, on the other hand, are experiencing low single digit returns and are still under or near their high-water marks. Now more than ever, it is critical that hedge funds know the full spectrum of hedge fund investors, understand what each of those investors require, and tailor their marketing strategy accordingly.

Over the past 36 months, we have worked with hundreds of hedge fund managers preparing to launch new funds as well as existing funds looking to expand their asset base. We realized that there was no clear and concise guide to help managers understand the full spectrum of hedge fund investors and which specific groups of investors they should be targeting.

So we created that guide: The Spectrum of Hedge Fund Investors and a Roadmap to Effective Marketing.

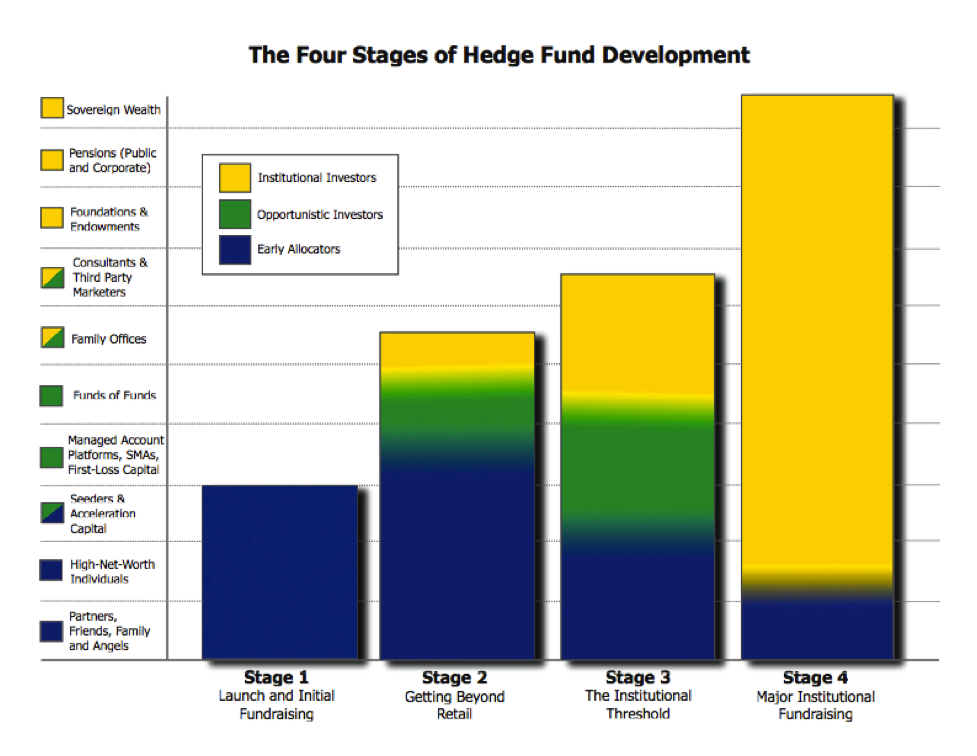

The article centers around the following chart, which lays out our four-stage roadmap to focusing on the appropriate investors at the appropriate time.

On the left side of the above diagram are the 10 levels of hedge fund investors, arranged along a spectrum that begins with early-stage retail allocators and progresses through the various layers of opportunistic investors leading to the major institutions.

There are several general qualities that change as a fund progresses through the different levels of investors. For instance, at the lower end of the spectrum, investors are relatively more tolerant of risk, volatility, limited infrastructure and idiosyncratic performance. As funds begin targeting investors further along the spectrum, they find more risk aversion and the expectation that funds need to have established track records of consistent alpha and minimal volatility. At the top levels of the spectrum, investors will only consider funds that can demonstrate operational best practices and clearly articulate their “edge.”

Along the bottom of the diagram are the four stages of a hedge fund’s lifecycle:

- Launch and Initial Fundraising

- Getting Beyond Retail

- The Institutional Threshold

- Major Institutional Fundraising

It is critical that funds understand which stage of development and growth best describes them and that they then focus their efforts on the appropriate targets.

The full paper, available here, provides a more detailed explanation of each type of investor, the four stages of a hedge fund’s lifecycle and the core marketing, communications and sales activities that fund managers should focus on as they seek to reach the next level of investor.

Leave a Reply